18th August 2021

Market Update

“Learn to be happy with what you have while you pursue all that you want” Jim Rohn

It’s fair to say that the news of late hasn’t been all that uplifting but, we have seen that the Australian economy has proven to be incredibly resilient in the face of adversity and, the panic surrounding the current COVID outbreak will subside as vaccination levels grow and things slowly go back to normal. The virus situation locally is clearly troubling, but consumers appear reasonably confident that it will come back under control, and that once it does, the economy will see a return to robust growth.

The availability of effective COVID vaccines looks to be a key source of support. Notably, sentiment is much stronger amongst those that have either been vaccinated or plan to get the jab with a combined sentiment read of 106.6.

The latest COVID-19 outbreak, and lockdowns have hit activity and eroded business confidence. These were the key findings of the recent NAB business survey conducted from July 20 to 30. Recall that the previous update was in the period from June 18 to 30 – at the outset of the recent outbreak and lockdowns. Not surprisingly business confidence has evaporated, plunging into pessimistic territory at -8 nationally. This is down 19pts a month ago and 28pts below the May reading. By way of comparison, the lows in recent cycles were: –30 in November 2008 during the GFC and –22.9 in the June quarter 1990 during the recession of that time. The chart below illustrates the industries that have been hardest hit by the recent outbreak.

There is also a clear loss of confidence across consumers. The Westpac-Melbourne Institute Index of Consumer Sentiment fell 4.4% in August to be down 12.4% from the 11yr high in April. Despite these falls, readings are still holding up better than might have been expected given virus developments.

At the risk of sounding repetitive the COVID situation is essentially driving every aspect of the Australian economy for now, from consumer sentiment to monetary policy. Suffice to say that the RBA will remain very accommodative when it comes to interest rates for the foreseeable future which only strengthens our argument that investors should seek higher yielding fixed income investments.

Globally on the virus, numerous anecdotes of concern over delta’s spread within China and other Asian nations have surfaced this week. Another large outbreak (or outbreaks) in the region cannot be ruled out and mass vaccination will be once again a very critical factor to fight this virus.

In the US despite having fully vaccinated over 60% of their population aged 18 and over, this week, it has been reporting over 120,000 new COVID-19 cases a day. This is around half the peak of December/January’s wave prior to the vaccination drive – it should be noted that the number of tests being completed is also about half that seen over the prior period. However, the very positive message is that the vaccines are working, and the number of hospitalisations is under control and live with COVID is possible.

As we have said in previous weekly’s the 3 main factors that will affect the global economy going forwards are employment, inflation and economic growth.

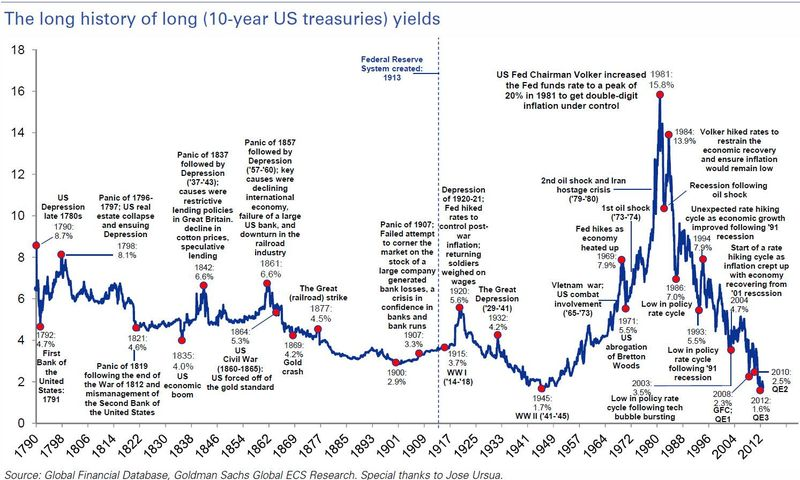

We have included the chart below for interests’ sake – apologies for not finding a more current chart but it’s interesting to see how US treasury yields have fluctuated over more than 200 years.

This week we look at an interesting topic which is discussed in a book titled “Fooled by Randomness” by Taleb. When it comes to markets part of the argument that “Fooled by Randomness” presents is that when we look back at things that have happened, we see them as less random than they were. Fooled by Randomness is about probability, not in a mathematical way but as scepticism. Randomness, chance, and luck influence our lives and our work more than we realize. Because of hindsight bias and survivorship bias we tend to forget the many who fail, remember the few who succeed, and then create reasons and patterns for their success even though it was largely random. Mild success can be explainable by skills and hard work, but wild success is usually attributable to variance and luck. We will be talking more about this next week as it applies to financial markets.